42+ how do you qualify for a reverse mortgage

Ad Take Our Suitability Test and find out if a Reverse Mortgage is the Right Choice. Ad Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today.

Can Anyone Take Out A Reverse Mortgage Loan Consumer Financial Protection Bureau

Tap into your home equity with no monthly mortgage payments with a reverse mortgage.

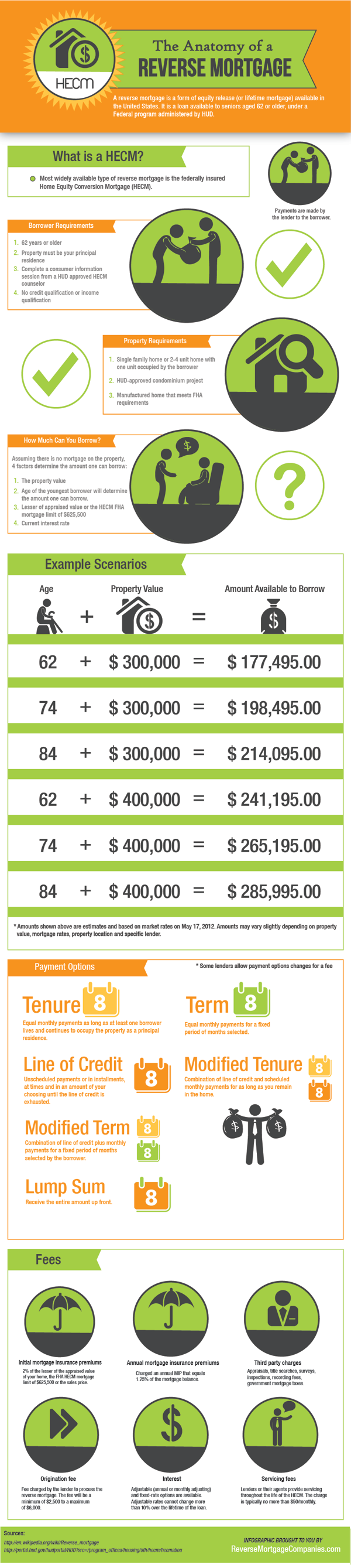

. Get a Free Information Kit Reverse Mortgage Calculator and Consumer Guide. Web A reverse mortgage is a type of loan that is used by homeowners at least 62 years old who have considerable equity in their homes. HECM borrower requirements Must be 62 or older Must live in the home as your primary residence.

Ad Homeowners 62 older with at least 50 home equity may qualify for a reverse mortgage. Thes most popular type of. Home equity conversion mortgage.

This is true for government-sponsored home equity conversion. Web Heres a look at how to qualify for a reverse mortgage. Learn More See If You Qualify.

In addition the loan may need to be paid back sooner such as if you fail to pay. Web If youre 62 or older you might qualify for a reverse mortgage. Shared Equity Is A Reverse Mortgage Alternative with Better Lenders Requirements.

Compare a Reverse Mortgage with Traditional Home Equity Loans. Ad Compare the Best Reverse Mortgage Lenders In The Nation. Web There are three different types of reverse mortgage loans from which you can choose.

With a reverse mortgage t he amount of money you can borrow is based on how much equity you have in your. The youngest borrower on title must be at least 62 years old live in the home as their primary. Web You must live in your home as your primary residence for the life of the reverse mortgage.

You can own your home free and. If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works. If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works.

Instantly estimate your reverse mortgage loan amount with the Reverse Mortgage Calculator. Ad How Does A Reverse Mortgage Work. Try Our Free Calculator To Receive a General Estimate If You Are Eligible.

Own the property outright or have paid down the majority of the mortgage because the general rule is that they must have at least 50 equity in. Web Reverse mortgage age requirements First and foremost the homeowner must be 62 or older. Web You will need to take out a jumbo reverse mortgage also known as a proprietary reverse mortgage for any amount more than 1089300 in 2023.

Web To qualify for this type of loan you must be 62 or older have enough equity in the home and use the home as a primary residence. Ad Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today. Ad While there are numerous benefits to the product there are some drawbacks.

Ad An Easier To Qualify Reverse Mortgage Alternative. Get Free Info Now. By borrowing against their equity.

Web The reverse mortgage appraisal must be conducted by an FHA-approved appraiser not all appraisers have this approval and it must follow a specific FHA format. Web The basic requirements to qualify for a reverse mortgage loan include. Heres how they work.

Web Be age 62 or older. Web Reverse mortgage loans generally must be repaid when you sell or no longer live in the home. Vacation homes or rental properties are not eligible.

You must own your home outright or.

Reverse Mortgage Calculator

:max_bytes(150000):strip_icc()/GettyImages-1124801805-281121e5ae6342a394c3e35d08cfb042.jpg)

What You Need To Qualify For A Reverse Mortgage

Reverse Mortgages Florida Access Reverse Mortgage

13 Reverse Mortgage Marketing Ideas Brandongaille Com

Age Requirements For A Reverse Mortgage

What Are The Eligibility Requirements For A Reverse Mortgage Youtube

Eric Hilario Mortgage Banker The Federal Savings Bank Linkedin

3 Important Qualifications For A Reverse Mortgage In 2023

What Is A Reverse Mortgage Quora

Nahb Report Optimistic About Reverse Mortgages

Nrmla Reverse Mortgage Brochures Reverse Mortgage Institute

Reverse Mortgage Eligibility Requirements

Reverse Mortgage Net

Reverse Mortgage Requirements Hecm Single Purpose Jumbo Loans Moneygeek Com

What Is A Reverse Mortgage Z Reverse Mortgage Visual Ly

Bob Davis Mortgage Loan Advisor First Bank Linkedin

Here Are The Income Requirements For A Reverse Mortgage